Anisotropic Conductive Adhesive for Mini-LED Displays:LED Chip Industry Cyclicality

Anisotropic Conductive Adhesive for Mini-LED Displays:LED Chip Industry Cyclicality

Solder Paste and Ultra-Fine Solder Manufacturer-Shenzhen Fitech is a comprehensive solder paste supplier integrating production, sales, research, and service of solder paste, epoxy solder paste, and solder powder. Fitech is the leading unit for the formulation of solder powder standards of the Ministry of Industry and Information Technology. Fitech's products include ultra-fine lead-free printing solder paste, ultra-fine lead-free dispensing solder paste, ultra-fine lead-free jetting solder paste, ultra-fine lead-free pin transfer solder paste, no-clean solder paste, water-soluble solder paste, high-temperature solder paste, medium-temperature solder paste, low-temperature solder paste, etc. Fitech can manufacture electronic-grade packaging solder powders with particle sizes from T2-T10.

Introduction

As of February 22, 2022, Focus Lightings was the only one that has released its 2021 performance report among LED chip companies. According to reports, Focus Lightings achieved an operating income of 2.009 billion yuan in 2021, reaching a year-on-year increase of 42.83%. The net profit and year-on-year increases were 177 million yuan and 728.43%, respectively. Although other LED chip companies have not yet released official reports, HC Semitek, Changelight, Azure, Silan, and other LED chip companies have released performance forecasts showing that their net profit has increased significantly. With the recovery of the prosperity of the LED industry, LED chips have once again become a heavy bet inside and outside the industry.

The "Leftover" of LED Chips are the Winner

The "Leftover" of LED Chips are the Winner

In 1999, the LED chip industry in mainland China officially entered its infancy. LEDinside, the Optoelectronics Research Office of Trendforce Jibang Consulting, pointed out that there were only 3 LED chip-related companies in mainland China in 1998. In 1999, the number increased to 6. From 1999 to 2009, 2-7 companies entered the LED chip industry every year, and the number of LED chip manufacturers increased to 62 in 2009.

Subsequently, the LED chip industry in mainland China entered a stage of massive investment. In 2009, the Yangzhou Municipal Government took the lead in introducing the MOCVD cash subsidy policy. The governments of Jiangmen, Wuhu, Hangzhou, Wuhan, and other places followed up quickly.

The MOCVD subsidy policy has directly led to the emergence of domestic LED extension chip projects. According to the statistics of LEDinside released by the Optoelectronics Research Office of Trendforce, a total of 65 new LED extension chip projects were established in China (2012 was the low tide of investment, but only in mainland China) from 2009 to 2012. By the end of 2012, the number of MOCVD equipment in China had exceeded 900.

With the rapid development of the LED chip industry in mainland China, the chip market share of Taiwanese and international manufacturers in mainland China has gradually declined. According to LEDinside, the domestic LED chip production rate in mainland China reached 80% in 2013.

However, there was another scene behind these achievements. According to statistics in May 2013, among the 65 newly established LED extension chip projects from 2009 to 2012, more than 30% of the projects were withdrawing or shelving. In 2012, China's MOCVD capacity utilization rate was less than 50%.

The reason behind this phenomenon is inseparable from an old saying in the LED chip industry called cyclicality.

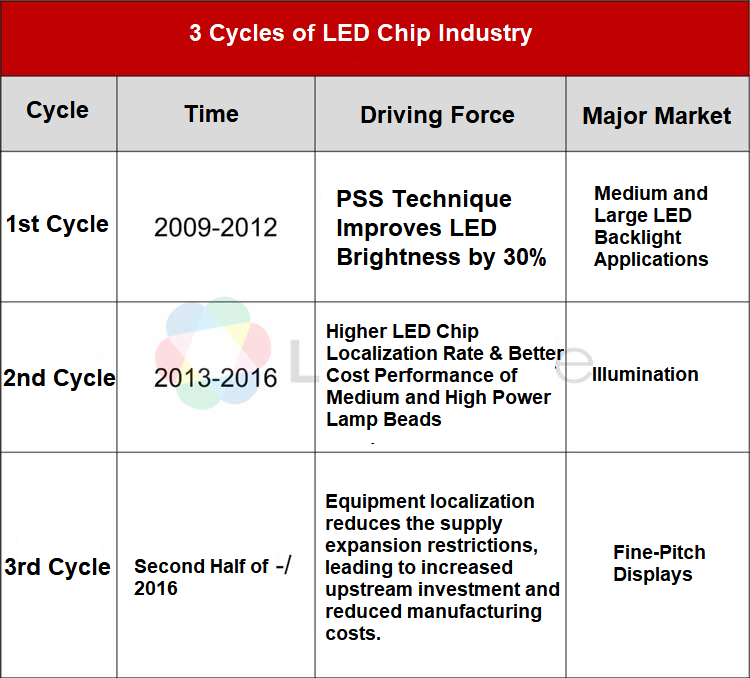

Since 2009, the LED chip industry has gone through three cycles, each of which has a similar situation.

Rising demand from new LED application scenarios - shortage of chip capacity supply - capacity expansion of original companies, the involvement of new companies - the balance of supply and demand, even with excess supply and demand - falling inventories and increasing competition - new applications for LEDs bring demand up.

Applications create demand. Demand drives production capacity improvement, and disorderly expansion of production capacity leads to oversupply roughly the same for each cycle. Each cycle has final winners.

Sanan Optoelectronics (listed in 2008), Qianzhao Optoelectronics (listed in 2010), and Huacan Optoelectronics (listed in 2012) have been listed successively. In 2009, ETI cooperated with Korea EPIVALLEY to introduce the MOCVD production line. Finally, they became the leaders of the first round.

Aucksun started to invest in factories at the bottom of the first cycle and successfully released production capacity during the upturn of the second cycle. Aucksun began to obtain revenue and profit in the third quarter of 2013 in the LED business, becoming the most potential company in LED chips. Focus Lightings was established in 2010, and subsequently established Porch Optoelectronics (2010). In June 2017, Focus Lightings was established in Suqian and successfully listed in October of the same year.

AMTC established AMTC Semiconductor in Nanchang in 2017 and successively invested in the construction of LED extension chips, blue-green light chip projects, and red and yellow light chip projects. In 2018, the first phase of the 100,000 piece/month chip production line of Zhaoyuan Optoelectronics started running. The second-phase project was approved this year. With the increase in production capacity, Zhao Chi Co., Ltd. and Zhao Yuan Optoelectronics are the shiny companies in the third round.

After three cycles, the number of LED chip companies in mainland China has decreased from more than 80 at the peak to about 14. The situation of many leading companies has formed.

The choice of LED chips on the eve of the market outbreak

The cyclicality of the LED chip industry has caused a number of companies to close down or withdraw. After a long downward cycle, the LED chip industry has gradually recovered in the second half of 2020.

It is difficult to eliminate the new coronavirus in the short term, and the terminal demand is different from the past. LED chip companies also have different layout options in the new market stage.

One is LED chip companies.

The first option is to quit the competition in the LED chip market. For example, Derun Haoda announced its exit from the LED chip business in 2019.

In recent years, LED chip companies have adjusted their production capacity structures based on the judgments on industry development trends and their own strengths.

This round of product structure adjustment can be traced back to 2019. At that time, the reversal brought about by the disorderly expansion of chip production capacity had already caused a decline in the unit price of LED chips in the traditional lighting field. The mid-to-low-end products were inadequate to guide the companies to move forward. Therefore, the adjustment of product structures has become the common choice of leading enterprises.

For example, since 2019, Sanan Optoelectronics has actively adjusted and upgraded its product structure. Low-end products would have a low storage level, and the popularization of high-end products mainly focused on mini/microLED, infrared, ultraviolet, automotive, and plant lighting. The profit of low-end products decreased, while the income of high-end chip products such as automobiles increased.

Generally speaking, in this round of product structure adjustment, mini and micro LEDs have become the major products of the layout. Horticultural lighting, automotive LEDs, and UV/IR LEDs have attracted the attention of the major LED chip companies.

In addition to accelerating the layout of application fields, the third-generation semiconductor has become an important upgrading direction for leading companies, such as San'an, Hc Semitek, Qianguang, Silan, Focus Lightings, etc., which have entered the third generation of compound semiconductors field.

The second is non-LED chip companies. LED companies were originally in the middle and lower reaches of the industrial chain, and in recent years they have often conducted upstream tests.

Leyard and Epistar were established in March 2020 in Wuxi. This strong joint force ensures the Leyard's stable chip supply channel. According to reports, most of the chips used by Leadstar are from Epistar.

At the same time, Leyard, Epistar, and Leadstar also jointly established the MicroLED Research Institute, dedicated to the development and application of micro-LED chips, micro-LED product driving technology, and system solutions, mass transfer technology and surface protection technology research, and providing research outcomes in Wuxi large-scale production base for application.

Mulinsen's entire industrial chain layout has expanded from LEDs to brackets, phosphors, and polymer materials. In terms of chips, Mulinsen obtained 26.88%, 25.50%, and 20.00% of Australian Shunchang, Crystal, and Core Semiconductors, respectively.

Mulinsen also attaches great importance to cooperation with LED chip suppliers. In April 2016, Mulinsen and Huacan Optoelectronics signed a strategic agreement on chip procurement with a total price of 1.5 billion yuan. As a traditional partner, Mulinsen built a factory with Epistar in India to explore the Indian market.

Nationstar Optoelectronics was established in 2011. On March 5, 2021, Nationstar Optoelectronics invested 220 million yuan in semiconductors to further optimize the structure of upstream chip products. On February 14, 2022, Nationstar Optoelectronics stated on the investor interaction platform that Nationstar has realized a bulk shipment of mini LED chips. At the same time, Nationstar has developed microLED chip series with P0.3 and P0.1.

Moreover, Nationstar Optoelectronics launched a silicon-based gallium nitride epitaxial chip at the upstream of the third-generation semiconductor.

MTC Semiconductor, as a chip subsidiary of MTC, is an important part of the upstream layout of MTC. In 2017, MTC announced to invest in the construction of the LED extension, chips, and mini/microLED semiconductor industrial park in Nanchang High-tech Industrial Development Zone. The first phase of the project would invest 10 billion yuan to build an LED extension and chip production base integrating R&D, production, and sales. Since its establishment, MTC Semiconductor has achieved blue-green light (sapphire-based gallium nitride material) and red-yellow light (Sapphire-based gallium nitride material). Besides, MTC realized the production rate of 650,000 4-inch wafers per month, which covered the entire product field of compound semiconductor LEDs (lighting and display).

On February 16, 2022, MTC held the LED display terminal project and equipment procurement signing event in Nanchang. MTC Semiconductor Park has planned to introduce 52-cavity micro-semiconductor UniMax extension process equipment and corresponding chip-side process equipment to increase the current overall production capacity of 4-inch semiconductor chips from 650 thousand pieces per month to 1 million-1.1 million pieces per month, 400 thousand of which would be fully invested in the new LED display field.

New Cycle arises New Competition

New Cycle arises New Competition

At present, the applications of LED are being further expanded. Since 2020, under the influence of the new coronavirus epidemic, China's LED industry has accelerated localization and substitution. In the background of increasing demand, the chips had experienced a round of global destocking. Because of shortages, the prices of mid-to-low-end chips also rose, and the market demand for mid-to-high-end chips also showed a dramatic climb. The application of products represented by mini/microLED will open a new round of the rising cycle in the LED chip industry.

In terms of mini-LED applications, Ledinside predicts that in 2022, many brands will join the mini-LED market, and the overall shipment volume of mini-LED TVs might exceed 4.5 million units.

Meanwhile, the delivery of mini-LED backlit LCD monitors, mini-LED backlit penlights, and other products will increase to varying degrees. Due to the high price, the product has just started, and the market size of mini-LED backlight LCD monitors is relatively limited. Looking ahead to 2022, QDOLED LCD monitors and OLED LCD monitors will increase the market share of high-end LCD monitors. Ledinside predicted that mini-LED LCD monitor shipments would reach 65,000 units in 2022 with an annual growth rate of 27%.

In terms of MicroLED, Ledinside mentioned that microLED large-scale displays would enter the home-theater-level and commercial display market, which was expected to promote the rapid growth of the output value of micro-LED large-scale display chips.

However, shopping malls are like a battlefield. At present, China's LED chip industry is at the bottom of the cycle ushering in a turning point in supply and demand. Therefore, it is a critical moment for enterprise transformation and upgrading, and even an important starting point for the re-segmentation of market shares in the future. LED chip companies will face a critical moment in the layout. The companies have to expand production capacity, strengthen R&D, mergers, etc. If they miss the new industry wave again, they may be the losers of the new round of competition in the future.

Source: LEDinside, retrieved by Shenzhen Fitech

Back to list

Back to list