T8 Solder Paste for MCU Package:Local MCU Market Development Direction

T8 Solder Paste for MCU Package:Local MCU Market Development Direction

Solder Paste and Ultra-Fine Solder Manufacturer-Shenzhen Fitech is a comprehensive solder paste supplier integrating production, sales, research, and service of solder paste, epoxy solder paste, and solder powder. Fitech is the leading unit for the formulation of solder powder standards of the Ministry of Industry and Information Technology. Fitech's products include ultra-fine lead-free printing solder paste, ultra-fine lead-free dispensing solder paste, ultra-fine lead-free jetting solder paste, ultra-fine lead-free pin transfer solder paste, no-clean solder paste, water-soluble solder paste, high-temperature solder paste, medium-temperature solder paste, low-temperature solder paste, etc. Fitech can manufacture electronic-grade packaging solder powders with particle sizes from T2-T10.

Introduction

JW Insights provides its ideas

- Currently, there are hundreds of MCU manufacturers in China, and the issue of benchmark imported chips is very tough, resulting in the homogenous competition of domestic MCU products, especially in the general-purpose MCU market.

-For specific vertical fields with large market demand, it is compulsory to launch dedicated MCUs with high performance and cost advantages, create differentiated competitive advantages, and continuously improve the ecosystem to achieve effective breakthroughs for domestic MCU manufacturers.

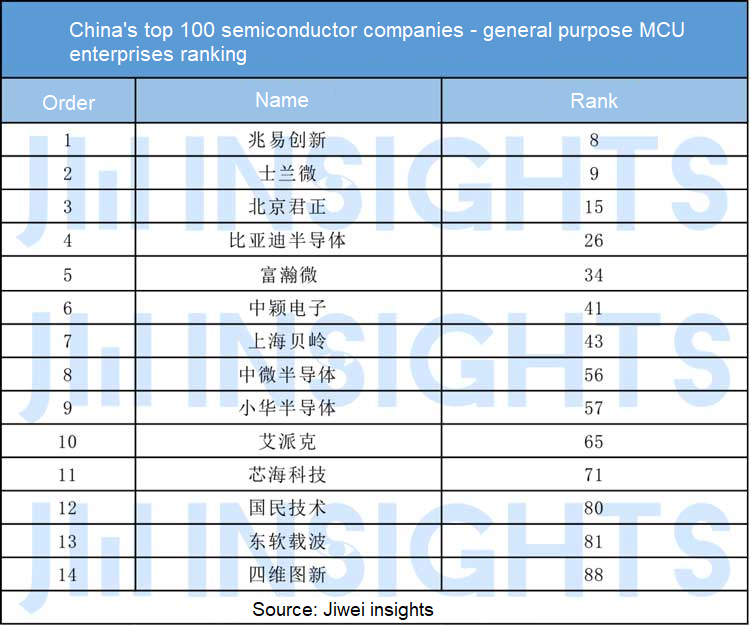

Recently, JW Insights released the list of China's top 100 semiconductor companies. In the top 100, there are many companies involved in the MCU business. More than ten semiconductor companies joined the field of general MCU, including Silan Micro, GigaDevice, Zhongying Electronics, Xinhai Technology, Xiaohua Semiconductor, Beijing Junzheng, BYD Semiconductor, Shanghai Belling, NavInfo, Apex, Eastsoft, National Technology, and China Micro Semiconductor.

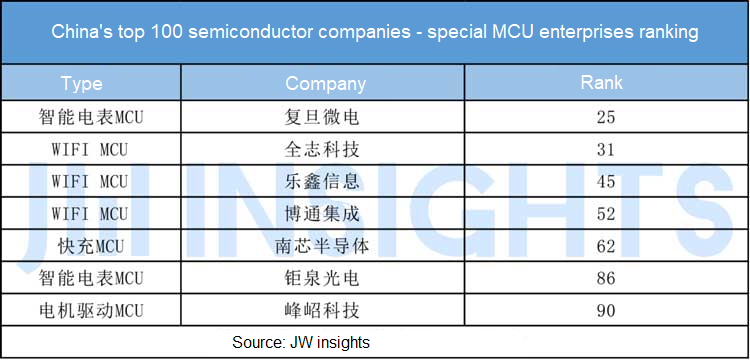

Fudan Microelectronics, High-trend Tech, Feng Technology, Allwinner Technology, Broadcom Integration, Lexin Information, Nanxin Semiconductor, and other semiconductor companies have been engaged in smart meter MCU, motor drive MCU, WIFIMCU, fast charging MCU, and other markets.

In addition, under the vigorous promotion of market demand and domestic substitution, semiconductor companies such as Guoxin Micro, Willsemi, SRIP, Torch Technology, Jereh Technology, and Credit Suisse have also launched general-purpose or special-purpose MCU businesses, and the domestic MCU industry is booming.

Domestic substitution is the main driving factor for the development of the local MCU industry

A microcontroller chip (MCU), also known as a microcomputer or single-chip microcomputer, is one of the core components of intelligent control of modern electronic information society. MCU is a microcomputer that integrates components such as a central processing unit (CPU), memory, timer/counter, various analog signal acquisition modules, and communication interfaces on a chip.

MCU is the heart of intelligent control with the function of signal processing and control. It is widely used in household appliances, consumer electronics, medical equipment, computers, industrial control, automotive electronics, and other fields.

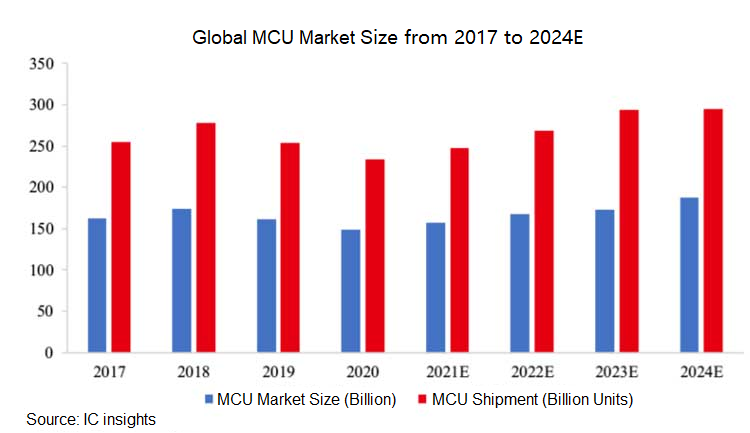

Recently, the global MCU shipments and market size have maintained steady growth driven by the IoT, automotive, electronics, and other markets. According to ICInsights' forecast, the global MCU market will reach an output of US$15.7 billion in 2021 and US$18.8 billion in 2024. The CAGR is expected to increase to 6.19% in 3 years.

In terms of market structure, the world's MCU supplies are still dominated by foreign manufacturers, and the industry concentration is relatively high. The world's top MCU manufacturers include Renesas Electronics (Japan), NXP (Netherlands), Infineon (Germany), Italian Semiconductor (Switzerland), Microchip Technology (USA), etc.

Imported chips occupy a major domestic market share. However, unlike the global demand for automotive electronics and industrial control products, consumer electronics is the mainstream China MCU market demand.

With the continuous trade tension between China and the United States and the shortage of imported chip supplies, domestic substitution has become the key factor in promoting the growth of the market share of local MCU brands.

General-purpose MCU competition heats up

Driven by the trends described above, local MCU manufacturers have achieved good revenue growth in recent years. In 2021, their performance doubled. 14 local MCU manufacturers have entered the top 100 list of Chinese semiconductor companies.

It is worth mentioning that there are many peers in the MCU market, and the competition is fierce. In addition to Renesas Electronics, NXP, Infineon, Italian Semiconductor, Microchip Technology, Texas Instruments, and other internationally renowned manufacturers, there are also Taiwanese manufacturers such as Holtek Semiconductor, Nuvoton Technology, Elan Electronics, and Sonix Technology, as well as hundreds of mainland China MCU manufacturers.

Although the MCU market size exceeds 10 billion US dollars, domestic MCU products will fall into homogeneous competition and price wars with the increase of domestic MCU manufacturers, especially in the general-purpose MCU market.

Taking 32 MCUs as an example, JW Insights learned that 32 mainstream MCUs on the market adopt the ARM cores. Although major manufacturers have launched MCUs based on RISC-V structure, due to the imperfect ecological environment, ARM core MCUs still adopt different process and performance parameters.

In addition, due to the strong domestic substitution demands, many local MCU manufacturers believe that higher cost performance and compatibility of local products are advantages compared with imported products.

Though the PCB design can avoid modifications and save costs in the replacement process, local manufacturers can also get better sales in a short period of time.

However, it further exacerbates the homogeneity of MCU products, resulting in a lower ability of local manufacturers to innovate products. They can only imitate the popular products on the market. Their own products are easy to replace. Hence, the loyalty of agents and customers to the brand will inevitably decrease, and the establishment of the brand image will not have a good effect. If local brands do not reflect the value of software, solutions, and applications, they will be stuck in a price war.

SAC Solder Paste SnBiAg Solder Paste SnBiAgSb Solder Paste SnBiAgX Solder Paste SnBi Solder Paste BiX Solder Paste AuSn Solder Paste SnSb Solder Paste SnPb Solder Paste Anisotropic Conductive Adhesive Ultra-Fine Pitch Flux

Dedicated MCU or local manufacturer breakthroughs

JW Insights believes that the smaller the differentiation of general-purpose MCU chips and the higher the degree of homogeneity, the greater the risk of falling into a price war. The effective ways to achieve breakthroughs for domestic manufacturers are to launch special-purpose MCUs with high performance and cost advantages for specific fields with large market demand to create differentiated competitive advantages and continuously improve the ecosystem.

For example, the IoT is a trillion-level market having an increasing demand for microcontrollers, which is one of the main growth points of the MCU market in the future.

As the core component of the IoT, MCU has tens of billions of devices. There are many chips in the market, but the diversification of IoT applications will inevitably promote the diversification of the upstream chip products. Introducing more subdivided and targeted customization products can help local manufacturers better position themselves in the market.

Currently, some local MCU manufacturers are working on implementing special-purpose MCUs, including home appliance control, motor control, smart water meters, smart electricity meters, fast charging, and TWS.

Among the top 100 semiconductor companies in China, 8 dedicated MCU manufacturers were shortlisted. Fudan Microelectronics and Juquan Optoelectronics are mainly engaged in smart meter MCUs. Full intelligent technology, Lexin Information, and Broadcom integration are involved in WIFI MCUs. Feng Intelligent Technology is focused on motor drive MCUs.

Due to the wide applications of MCUs, a variety of functions are required in different application fields. Dedicated MCUs supporting security, artificial intelligence, algorithms, wireless communication, sensors, driver chips, power management, customized communication protocols, and hardware interfaces were launched for various industries.

JW Insights believes that the MCU market will develop in the direction of energy-saving, intelligent, safe, light, short, and multi-functional integration. However, with the advent of the IoT, more and more popular segmented application markets will emerge one after another, which will also promote the emergence of a large number of innovative special-purpose MCUs in the industry. Relied on localization, domestic manufacturers can respond to market demands faster and achieve breakthroughs in market segments.

Source: JW Insights News, retrieved by Shenzhen Fitech

Back to list

Back to list